End of year tax tips 2020

End-of-year tax tips individual

The box 3 reform proposed earlier has been withdrawn this year. Instead, the tax-free allowance will be increased to € 50,000 per person next year; to keep it completely budget neutral, the rate will go up a little. The transfer tax will be reduced from 2% to 0% for first time buyers under certain conditions; on houses and other real estate not occupied by taxpayers themselves, the levy will increase from 2% or 6% to 8%. Despite the fact that the measure is mainly presented as a reduction, this tax will actually increase on balance.

Index individual tax tips:

- New rates in the Income Tax

- 30% ruling end

- Reduction of the rate of deductible items for higher incomes

- Improvement of allowances

- Changes in transfer tax

- Save in box 3 with an OFGR or BV

New rates in Income Tax

Box 1 – Income from work and home

In 2020, the two-bracket system was introduced for box 1 income such as wages. For 2021, the rate is 37.10% for income up to € 68,507 and 49.5% for income above € 68,507. For taxpayers who have reached the state pension age, an adjusted rate of 19.20% applies for income up to approximately € 35,000, since the social premium rate is lower.

Box 2 – Income from a substantial interest (for example, a BV)

The rate for income from a substantial interest or substantial shareholding was 26.25% in 2020. Last year it was already determined that this rate would increase further to 26.9% in 2021. For more information, please refer to the business section in this newsletter.

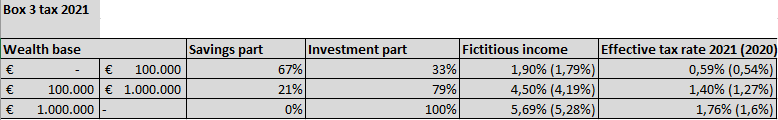

Box 3 – Gains from savings and investments

In box 3, the capital is taxed on the basis of a notional return or deemed income. The plan for reform of box 3 presented last year, whereby different rates would apply to savings, other assets and debts, has been withdrawn by the State Secretary. Other complications would have arisen with that system.

Instead, the tax-free allowance will be increased in 2021 from € 30,846 per person to € 50,000 per person (€ 100,000 for tax partners). As a result, nearly 1 million savers will no longer pay box 3 tax compared to 2020. The brackets will also be adjusted this year.

In 2021, bracket 1 will run from € 50,000 to € 100,000 (this was € 30,849 to € 103,643). In 2021, bracket 2 will run from € 100,000 to € 1,000,000 (this was € 103,643 to € 1,036,418). Bracket 3 will run from € 1,000,000 in 2021 (this was € 1,036,418).

In order to keep the levy budget neutral, the rate on the notional return in box 3 will be increased from 30% to 31%. This is the first time since 2001 that the tax rate in box 3 has been increased.

Below is a schematic representation of the capital gains tax in 2021. The percentages for 2020 are stated in brackets.

30% ruling end

Did your 30% ruling start between January 1st 2013 and January 1st 2016 ? In that case your 30% ruling will end as per January 1st 2021. This means that from then on your take-home salary will be lower. Also, since you can no longer opt to be considered a partial non-domestic taxpayer, you will become regularly taxable in the Netherlands for your worldwide assets. It is important that you are aware of the tax consequences.

Reduction of the rate of deductions for higher incomes

As already mentioned last year, the highest rate at which all deductible items can be deducted is gradually being phased out. It can therefore be advantageous to pull forward deductible costs where possible. Taxpayers whose income falls in the highest bracket in box 1 will gradually have less tax benefit from these deductions. In 2021, these deductible items may be deducted at a maximum of 43% compared to 46% in 2020.

This percentage will be further reduced in the coming years to the level of the first bracket, approximately 37% in 2023. This concerns the following deductible items:

- Alimony

- Deduction of tuition fees

- Deduction of expenses for specific healthcare costs

- Deduction of weekend expenses for the disabled

- Gift deduction

- Mortgage interest deduction

- Entrepreneur’s allowance (self-employed person’s allowance, research and development work deduction, co-workers’ allowance, starter’s allowance in the event of disability, discontinuation credit)

- Profit exemption for small and medium sized businesses

As a result of this reduction, the deductible items will yield more in 2020 than in 2021 and the following years. If your income is taxed in the highest tax bracket in 2020, it is therefore advisable, if possible, to pay deductible items such as gifts or healthcare costs before the end of the year.

Improvement allowances

Partly due to the child allowance affair, the cabinet is working on improving the allowance system. The 2021 Tax Plan sets out 3 steps for how the cabinet wants to achieve this. These steps are: improving legal protection, making the measure more human and changing the concept of partnership. For example, taxpayers must be able to respond earlier to a proposed decision by the Tax Authorities, the Tax Authorities may only stop benefits if a citizen has been given sufficient opportunity to provide their own information and the Tax Authorities will soon be able to request more information from other parties. Amounts smaller than € 98 will no longer have to be repaid from 2021. And any partner will no longer be counted for the entire allowance year, but from the first of the month after the partnership has started. This way, situations are resolved where people had to repay part of their allowances.

Changes in transfer tax

From the year 2021, a first time buyers exemption will be introduced. Buyers between the ages of 18 and 35 do not pay a one-off transfer tax for their own home. The condition is that the buyers themselves will live in this house, have not previously used the exemption and the house does not cost more than € 400,000 (if the transfer takes place after March 31, 2021, between January 1 and March 31, 2021). this limit does not apply). The house does not have to be the first owner-occupied home.

If one of the buyers is 35 years or older, this person pays 2% transfer tax on his / her part of the house. The moment of transfer of the house is decisive and not the moment of signing the purchase agreement.

From 1 January 2021, the transfer tax will also be increased for homes that are not purchased as an owner-occupied home in which the taxpayer himself lives (for example, a home intended for rental or as a holiday home or a home purchased by a parent for his child). from 2% to 8%. The rate will also increase for other real estate, such as commercial properties, from 6% to 8%.

Save in box 3 with an OFGR or BV

If you have substantial capital and therefore pay tax in especially the higher box 3 brackets, it may be an option to set up an OFGR or BV to save box 3 tax. If you transfer the capital to this entity, this capital will be taxed in the corporate tax and substantial interest tax on the actual return on this capital.

The advantage is that this capital is then no longer taxed in box 3 at a (high) notional return. This is mainly advantageous for low-yielding capital such as savings accounts. We recommend that you first discuss the options with an advisor to see whether this will benefit your situation.

You can also save on box 3 tax by reducing the balance for the reference date of January 1, for example by bringing forward expenses, mortgage repayments, annuity deposits or payment of health insurance.

Cash donations are no longer deductible

From the year 2021, gifts that you pay in cash to an ANBI charities are no longer tax-deductible. Gifts must always be proven with supporting documents (such as bank statements). Where possible, it is therefore preferable to transfer donations by bank. Some charities have already responded to this by, for example, offering the option of paying by pin or transferring via a payment app.

Take advantage of the annual gift exemption

Have you not yet used the annual donation exemption this year? You have until December 31st to make these donations. Please note that the money must be credited to the recipient’s account by December 31, 2020 at the latest. In 2020 a general exemption of € 2,208 applies. An exemption of € 5,515 applies for gifts to children. In addition, there are a number of one-off gift exemptions. Do you have any questions about this? We are happy to provide further explanation.

Other tax tips

- Do you expect to have to pay tax for the 2020 or 2021 tax year? Request a provisional assessment in good time, this will save you interest. You pay interest if the assessment is imposed later than 6 months after the end of the calendar year (1 July 2021). The interest is at least 4%. To ensure that the assessment is imposed on time, we recommend that you apply for it before April 1, 2021. The assessment for the 2020 tax year must be paid in one go. You may pay the assessment for the 2021 tax year in installments. Do you have any questions about this? We are happy to assist you in applying for a provisional assessment.

- If you expect to receive a refund for the year 2015, an Income tax return for this year must be submitted before 31 December 2020. In 2021, the 5-year period for submitting this declaration will expire.

- If possible, bundle deductible costs such as medical expenses and gifts in one specific year. For example, a deduction is achieved earlier and the threshold is only deducted once from the expenditure. For donations, the threshold no longer applies if you commit the donation to a charity for 5 years. In addition, an increase of 25% applies for donations to a cultural institution (up to a maximum of € 1,250 extra).

- Do not wait until December 31 to transfer amounts. The date on which you transfer the amounts is not always the date on which the amount is transferred by the bank. Although many banks switched to a system in which this is the case last year, this does not yet apply to all banks. We therefore advise you to transfer the amounts a few days before the 31st.

- If you do not meet the conditions for tax partnership, but do live together and you want to be treated as tax partners before 2020 in order to optimally benefit from the benefits of the tax partnership, you still have until to arrange. You can conclude a cohabitation contract with the civil-law notary for this.

- Did you receive a gift in 2018 and then made use of the one-off increased exemption for the home? Then you still have until the end of this year to spend this money on your own home (purchase, renovation or repayment of the mortgage). Are you not doing this? Then gift tax will still have to be paid on the amount that has not been spent on the owner-occupied home.

- Did you have solar panels installed during 2020 and have you not yet reclaimed the VAT? You have until 30 June 2021 at the latest to reclaim the VAT.

End-of-year tax tips Business

In the business area, the planned reduction in the highest corporate tax bracket is canceled. To compensate for this to some extent, an investment discount (BIK) will be introduced for SMEs. All this is intended to keep investments up to standard in these times of crisis. Furthermore, measures are planned to counter advantageous tax structures for multinationals; however, as far as loss compensation is concerned, all companies, including those without international interests, may notice the effects.

The extensive support measures to businesses in the context of the corona crisis will largely continue until 1 July 2021. We will have to wait and see what new plans the next cabinet will present after the elections in March next year.

Business tax tips index:

- Change in box 2 and corporate income tax

- Investment discount

- Adjustment of loss compensation and international transactions

- Reduction of self-employed person’s allowance

- Free space adjustment

- Additional tax liability electric car

- Payment discount for corporate tax

- Increase in the rate of the innovation box

- Other tax tips

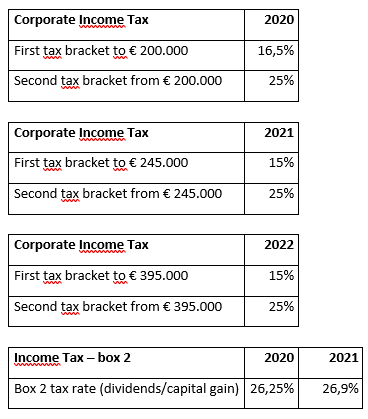

Change in box 2 and corporate income tax

As announced last year, the corporate tax rate will be reduced in the coming years. In addition, the tax brackets will also be adjusted. The corporate tax rate was 16.5% on the first € 200,000 profit and for profits in excess of € 200,000, this was 25% in 2020. In 2021, the rate will be 15% on the first € 245,000. The rate for profits above € 245,000 remains 25%.

In 2022, the tax brackets will be adjusted again and the first bracket will be increased to € 395,000. Last year it was promised that the high corporate income tax rate of 25% would also be lowered further. This is however cancelled. The government will use the proceeds to finance the corona measures and a scheme that encourages entrepreneurs to invest.

The rate for box 2 will be adjusted as planned. This concerns income from a substantial interest, such as dividends and capital gains on equity interests above 5%. The current rate of 26.25% will be increased to 26.9% in 2021. If you, as a director and major shareholder, are considering paying out dividends, this is most beneficial before the end of the year so that you benefit from the lower rate.

Investment discount

A new investment discount is being created; the BIK (Job-related Investment Discount). This scheme is intended to ensure that entrepreneurs continue to invest in new business assets, even in times of crisis. Companies can offset the investment discount against the wages tax to be paid.

The scheme applies to new investments made from January 1, 2021 to December 31, 2022. A lower limit of € 1,500 per business asset and € 20,000 per application applies. A maximum of 4 applications may be made per year. The investments must be paid in full in 2021 or 2022 and taken into use within 6 months after full payment. With large investments in a year, the discount is3.9% up to amounts of € 5,000,000, above that a discount of 1.8% applies.

Adjustment of loss compensation and international transactions

The cabinet wants to tax multinationals more fairly. At present, it may happen that companies that make a profit in the Netherlands do not have to pay tax on this in the Netherlands as they can offset losses or claim certain tax deductions. The government will tackle this problem by means of two measures which, incidentally, may also apply to companies other than multinationals.

The first measure is to limit loss compensation. Currently, companies can offset losses against profits from the previous year or the six consecutive years. No maximum amount applies. From 2022, up to € 1,000,000 of the profit can be offset against losses. Only 50% of the profit that exceeds € 1,000,000 be set off against tax losses. In addition, the time limit of 6 years will be cancelled; losses can be settled indefinitely. Unfortunately, the restriction applies to all Dutch companies, regardless of whether these losses originate from abroad. For small companies, the longer term for loss set-off may actually be an advantage.

The second measure is that informal capital structures are tackled. In the current situation, it may happen that in an international transaction a company in the Netherlands can deduct the costs, but does not pay tax on the corresponding proceeds in the other country. As of 2022, no more costs may be deducted from the profit in the Netherlands if no amount or if less than an amount at arm’s length is included in the tax base in the other country.

Reduction of self-employed person’s allowance

As announced last year, the self-employed deduction is being reduced from 2020 onwards. The plan was to reduce this to € 5,000 in nine years. Now the self-employed deduction will be further reduced to € 3,240 in 2036. In 2020 the maximum self-employed deduction was € 7,030. In 2021, the maximum self-employed deduction is € 6,670.

The entrepreneur will be compensated for the reduction in the self-employed deduction by the increase in the employed person’s tax credit and the reduction of the basic income tax rate to 37.10%. In time, the self-employed will pay more tax due to the further decrease in the self-employed deduction.

Increase tax free reimbursement

Employers may reimburse certain expenses to their employees tax free up to a maximum percentage of the total wage sum. In the context of the corona support measures, the maximum tax free reimbursement to employees has been temporarily increased from 1.7% to 3% over the first € 400,000 of the wage sum. However, this is a temporary measure that only applies for the 2020 tax year. Do you still want to make use of this? Then you still have up to and including 31 December 2020 to reimburse the employee for certain costs tax-free. A bonus can also be paid out under this arrangement if this is customary (partly depending on the amount of the bonus). In 2021, the free space will remain 1.7% over the first € 400,000 of the wage sum. The percentage will be reduced to 1.18% on the excess. This was 1.2% in 2020. This arrangement comes in addition to expenses which are tax free anyway, such as claiming business mileage at € 0.19 per km. Please contact your advisor for further information about the conditions.

Private use electric car

As announced last year, the fictitious amount for private use (bijtelling) of electric cars will be further increased. In 2021, this will be increased to 12% over the first € 40,000 (this was 8% over the first € 45,000) and 22% over the excess. In 2022, the addition for the first € 40,000 will be increased to 16% and in 2025 to 17%. An exception to this regulation are solar cell cars. The maximum catalogue value does not apply to these cars.

Payment discount corporate tax

At present, the Tax Office grants a payment discount if a provisional assessment for corporation tax that may be paid in installments during the year, is paid in one go. This payment discount will be abolished from 2021. According to the government, this is to prevent abuse.

Increase in the rate of the innovation box

When a company makes a profit from certain innovative activities, they may have to pay less corporate tax on this profit by applying the innovation box. The effective tax rate of this innovation box increases from 7% to 9%.

Corona measures

The cabinet has introduced many compensation measures this year in view of addressing the corona crisis. A number of these measures have been extended or legally formalised. The most important measures from the third support package, such as the NOW, TVL and Tozo, have been extended until July 1, 2021. The NOW (Emergency Bridging Measure for Employment) provides compensation for wage costs in the event of a loss of turnover of at least 20% in order to maintain as much employment as possible.

The Fixed Cost Allowance, or TVL, helps SMEs to pay part of their fixed costs. The allowance of a minimum of € 750 and a maximum of € 90,000 is for companies that have lost more than 30% of their turnover as a result of the corona crisis. The Tozo (Temporary bridging scheme for self-employed persons) is a living allowance for the self-employed. The income is thus supplemented to the social minimum. The schemes have different deadlines and must be requested from different authorities. You can find more information about this on the website of the Dutch government https://business.gov.nl/corona/overview/the-coronavirus-and-your-company/ .

In addition, the tax authorities have also offered the option of postponing payment. The special deferment of payment ends no later than 1 January 2021. At the next tax return, the tax will have to be paid again within the normal term. A maximum repayment term of 3 years applies to the outstanding tax debt.

Other tax tips

- Do you have a lot of savings and you own a private limited company (B.V.)? You can consider transferring these savings by means of a share premium deposit before the end of the year in the B.V. If the payment is made before the end of the year, you will no longer have to pay a box 3 levy on that amount in 2021. It is important that you are aware of the conditions and consequences.

- Do you have a sole proprietorship or partnership? If you keep the working capital in the company up to a certain level, you may be able to save box 3 tax. For example, if you wait until after 1 January with a large private drawing, you do not have to pay a box 3 levy on that amount. It is important, however, that the balance in the business account is not so high that the amounts will be seen as surplus for business operations. If you plan to make large expenditures for the company in the future and therefore want to reserve money for this now, this is a reason to keep more capital in the company than usual.

- Do you expect to have to pay tax for the 2020 or 2021 tax year? Request a provisional assessment in good time, as this will save you tax interest. The tax interest for income tax entrepreneurs is currently 4%. For corporate tax this percentage is normally 8%, but this has been reduced to 4% in connection with the Corona crisis. This measure has been extended until December 31, 2021 (refer to the chapter on corona measures).

- Have you found out that you forgot to include some items in your VAT return? Then file a supplement declaration. You can do this for this year or for the past 5 years. If it concerns VAT of € 1,000 or less to be received or paid, this may be included in the next VAT return. You do not need to submit a separate supplement declaration for this.

- Do you drive a company car and do you use this car privately? In that case, a correction must be made for private use in the last VAT return (to be submitted in January 2021). This is allowed on the basis of actual use or on the basis of a fictitious amount. Do you have any questions about this? We are happy to help you.

- As a director major shareholder (DGA), do you use computers, laptops, tablets or mobile phones for your work? These can be provided or reimbursed tax-free.

- As already indicated, the rates of income tax, corporation tax and the tax rate in box 2 will be adjusted. This offers interesting planning options for, for example, the choice between paying wages or dividends. We are happy to look at optimising the possibilities with you.