Newsletter End of year tax tips 2021

We would like to inform you about the latest tax changes and saving opportunities with this end-of-year newsletter. We hope you will benefit from this newsletter. Please contact our office for more information and personal advice. We have distinguished our tips and hints between Individual and business. Please go ahead and read what applies to your situation!

Tax plan summary

As expected, the current outgoing government will not come up with any sensational plans for 2022. The plans largely concern previously taken decisions and smaller changes. The more notable changes are, for example, the abolition of the personal tax deduction for educational expenses and the arranging of a work from home allowance. Furthermore, the first bracket in the corporate income tax will be extended from € 245,000 to € 395,000. For 2023, the percentage of tax deductions in the Income Tax will decrease again by 3%; if it is possible to bring forward deductible expenses, the deduction will yield more this year. The plans are not final yet, as the Eerste Kamer(Dutch Upper House) has yet to vote on them.

Individual

Index individual fiscal tips

- New Income Tax rates

- Reduction in the rate of deductible items for higher incomes

- 30% ruling end

- Replacement deduction for training costs

- Changes in primary residence scheme

- Transfer tax

- Rent allowance

- Change in income-related combination discount for foreign workers

- Save tax in box 3 with an OFGR or BV

- Take advantage of the annual gift tax exemption

- Provisional assessment

- Saving tax in box 3

- Other tax tips

New income tax rates

There are no substantial changes in the Income Tax rates, only minor deviations and inflation adjustments.

Box 1 – Income from work and home

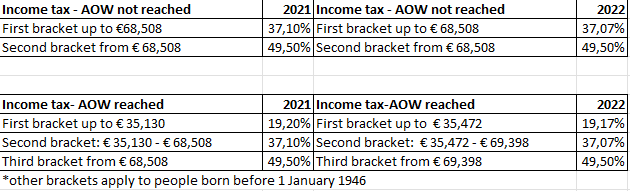

In 2022, the rate in the first bracket will be reduced from 37.10% to 37.07%. The threshold for the first bracket has also been raised this year, from € 68,507 to € 69,398. The rate for the second bracket remains 49.50%. After 2022, the basic rate will be further reduced step by step to 37.03% in 2024. Below is a schematic representation of the income tax in box 1 in 2021 and 2022.

A three-bracket system still applies to taxpayers who have reached the state pension age. Disc 1 goes from 19.20% to 19.17%. The second bracket goes from 37.10% to 37.07% and the third bracket remains 49.50%. Below is a schematic representation of the income tax in box 1 in 2021 and 2022.

Box 2 – Income from a substantial interest (for example a BV)

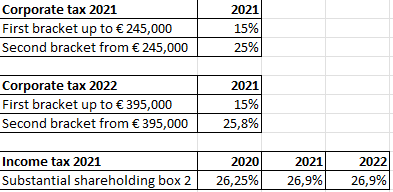

The rate for income from a substantial interest remains 26.9%.

Box 3 – Benefits from savings and investments

There is as yet no prospect of taxation on the assets in box 3 over the actual income.

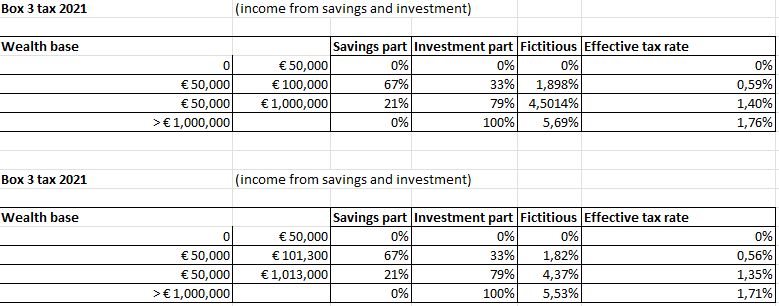

In 2022, the tax-free allowance will be increased from € 50,000 per person to € 50,650 per person (€ 101,300 for tax partners).

In 2021, the rate on the notional return in box 3 has been increased to 31%. This rate will not be adjusted in 2022.

Below is a schematic representation of the capital gains tax in 2021 and 2022.

Reduction in the rate of deductible items for higher incomes

As already mentioned in 2020 and 2021, the highest rate at which virtually all deductible items are to be deducted is gradually being decreased. It can therefore be advantageous to bring forward deductible costs where possible. Taxpayers whose income falls in the highest bracket in box 1 will gradually have less tax advantage from these deductible items. In 2022, these deductible items may be deducted at a maximum of 40%, compared to 43% in 2021.

This percentage will be further reduced to the level of the first bracket, 37.03% in 2024. This concerns the following deductions:

- Alimony

- Deduction of training expenses (only in 2021, see separate chapter)

- Deduction of expenses for specific healthcare costs

- Deduction of weekend expenses for disabled

- Gift deduction

- Mortgage interest deduction

- Entrepreneurial deduction (self-employed deduction, research and development deduction, cooperation deduction, starter’s deduction in the event of incapacity for work, discontinuation deduction)

- Profit exemption for small and medium-sized businesses

Due to this reduction, the deductible items will yield more in 2021 than in 2022 and the following years. If your income falls in the highest tax bracket in 2021, it is therefore advisable, if possible, to pay deductible items such as gifts or healthcare costs before the end of the year.

30% ruling

Did your 30% ruling end on January 1st 2021? This means that your take-home salary has been lower. Also, you have become regularly taxable in the Netherlands for your worldwide assets and you will have to declare these in your 2021 tax return. You can read our tax tips regarding saving in Box 3 to see how you can minimize your Box 3 tax.

Replacement deduction for study costs

From the tax year 2022 onward, study costs are no longer deductible from the income tax. The tax deduction will be replaced by the STAP budget subsidy scheme (Incentive for the Labor Market Position). This budget will apply to people with a link to the Dutch labor market. From 1 March 2022, workers and job seekers can apply for a STAP budget at the UWV. This is possible per person once a year. The budget is €1,000 per person per year. If the application is approved, the amount is paid to the trainer. Only study costs paid in 2021 can still be deducted in the 2021 income tax return.

Changes in primary residence scheme

From 2022, the primary residence scheme will be adjusted in 3 parts. The scheme is being adjusted because unintended deduction restrictions occurred in marriage and partnership, which sometimes meant that less mortgage interest could be deducted. This occurred, for example, in people who bought a house with a partner, but had previously bought a house themselves (and had sold it with equity). Or with people who have a primary residence and of which one of the partners dies. It is adjusted for the components: home acquisition reserve, repayment position and home acquisition debt. If this applies to you, we are happy to provide further explanation.

Property transfer tax

It is important to take into account unforeseen circumstances before transfer at the notary!

The start-up exemption has been introduced from the year 2021. First-Time Buyers between the ages of 18 and 35 (under certain conditions) do not pay a one-off transfer tax for their own home. Buyers from the age of 35 who are going to live in the house themselves pay 2% transfer tax. Buyers who are not going to live in the house themselves pay 8% transfer tax. It had already been arranged that in the event of unforeseen circumstances buyers could pay the 2% transfer tax and not the 8% after transfer at the notary, but nothing had yet been arranged for the period between the purchase and transfer at the notary. This will now also be taken into account from 1 January 2022. For example, if the buyers would divorce before the transfer at the notary, but after signing the purchase contract, and as a result, they will not live in the house themselves? Then they only have to pay 2% transfer tax and not 8%.

Rent allowance

The cabinet wants renters to receive or keep rent allowance more often. The current conditions will be relaxed on two points. From 1 January 2022, the application for a residence permit for children up to the age of 18 is no longer a condition for entitlement to housing benefit. In addition, from 1 January onward, the right to rent allowance in the event of exceeding the rent limit will be reinstated. Renters will again be eligible for housing benefit if their income or assets fall again and if they were entitled to housing benefit in the past regarding their house.

Change in income-related combination discount for foreign workers

The income-related combination discount can be applied to people with children under the age of 12. The conditions are that both partners work. For people who work in the Netherlands but live abroad, a partner who lives abroad does not count as a tax partner in the Netherlands. As a result, there was an unintended entitlement to the income-related combination tax credit in the past. From 2022, the partner abroad will now also be included to check whether they are entitled to this tax credit. The income-related combination discount will be reduced from a maximum of €2,815 to €2,534.

Save tax in box 3 with an OFGR or BV

If you have substantial assets and therefore pay tax in the higher box 3 brackets, it could be an option to set up an OFGR or BV to save box 3 tax. If you transfer the capital to this entity, this capital will be taxed in the corporate income tax and substantial interest taxation for the actual return on this capital.

The advantage is that this capital is then no longer taxed in box 3 at a (high) notional return. This is especially beneficial for low-yielding assets such as savings accounts. We recommend that you first discuss the options with an adviser to see whether this will benefit your situation.

You can also save on box 3 taxation by reducing the balance before the reference date of 1 January, for example by bringing forward expenses, mortgage repayment, annuity deposit, or payment of health insurance.

Take advantage of the annual gift tax exemption

Have you not yet made use of the annual gift exemption this year? You have until 31 December to make these donations. Please note that the money must be credited to the recipient’s account by December 31, 2021 at the latest. In 2021, the annual tax-free amounts will be temporarily increased by € 1,000 due to the Corona crisis. There is a general exemption of € 3,244. An exemption of € 6,604 applies to gifts to children. In addition, there are a number of one-off gift exemptions (for example, for a study or the purchase of a primary residence). If you have any questions regarding these exemptions, we will be happy to assist you.

Provisional assessment – recommended if you receive several pensions

If you receive a pension from several pension institutions, you often have to pay an additional amount in income tax when you file a return. This is caused by the fact that your total income falls in a higher bracket due to the various pensions. The pension authorities are not aware of your total income and only withhold tax on the amount they pay you. As a result, it is possible that too little wage tax has been deducted from the pensions and that you have to pay extra. You can request a provisional assessment to limit tax interest and to be able to pay the amount of income tax in installments. Do you think this situation applies to you? Or are you retiring soon? Please contact our office. We would be happy to see if it is wise to request a provisional assessment from the Tax Authorities.

Saving tax in box 3

The reference date for taxed box 3 assets is January 1. Here are a few tips to reduce your assets as of 1 January.

- Do you plan to make major expenditures soon? Such as, for example, the purchase of a car, renovation of a house or consumer goods. Then it might be wise to make the purchase before 1 January. In this way you reduce your taxable assets.

- You can use your savings to pay off part of the mortgage on the primary residence (box 1). In addition to wealth tax, this often also saves you some mortgage interest. Ask your mortgage lender about the conditions in order to prevent/limit penalty interest. Have you received a provisional refund in connection with the mortgage interest? Do not forget to adapt this to the new situation.

- If possible, you can ask your health insurer whether it is possible to pay the health care premium in one go (before 1 January) instead of paying in installments. You often also receive a small discount for paying the premium all at once.

- It can be beneficial to have small debts (together below the threshold of € 3,200 per taxpayer) repaid before January 1. In this way, the box 3 income is reduced and further interest on these loans is also avoided. Interest on personal loans is usually high and this interest is not tax deductible.

- Deposit money into an annuity. Money that has been deposited as an annuity is no longer taxed in box 3. A deposit is worth considering, especially in the event of a pension shortfall. There are conditions attached to this.

- If you have not yet made any donations this year, you can consider making them before 31 December.

Other tax tips

- Do you expect to pay tax for the 2021 or 2022 tax year? Request a provisional assessment in good time, this will save you tax interest. You pay tax interest if the assessment is imposed later than 6 months after the end of the calendar year (1 July 2022). The tax interest is at least 4%. To ensure that the assessment is imposed in time, we recommend that you apply for it before 1 April 2022. The assessment for the 2021 tax year must be paid at once. There is the possibility of paying the assessment for the tax year 2022 in installments. Do you have questions about this? We are happy to assist you in applying for a provisional assessment.

- If you expect to receive a refund for 2016, an Income Tax return for this year must be submitted before December 31, 2021. In 2022, the 5-year term for submitting this declaration will expire.

- If possible, bundle deductible expenses such as medical expenses and donations in one specific year. For example, a deduction is achieved earlier and the threshold is only deducted once from the expenses. For donations, the threshold disappears completely if you commit the donation to a charitable institution for 5 years.

- If your capital in the bank is higher than € 100,000, you may be confronted with negative interest. To avoid this, you can divide your money among several banks. Do ask for the conditions at the various banks. Negative interest may already be calculated for an amount lower than € 100,000.

Business tax tips 2021

Last year, the plans for an investment discount for SMEs (the BIK scheme) ultimately did not go ahead. This plan was to replace the cancellation of the plan to reduce the corporate income tax rates. This is probably due to the large expenses that the government has had to spend in order to support businesses during the corona crisis. We hope the reduction in corporate income tax for SMEs will eventually yet take place. For next year, however, an increase is planned in the second bracket from 25% to 25.8%. The first bracket in the corporate income tax has been extended from € 245,000 to € 395,000.

This extension benefits SMEs. As a result, doing business in a BV becomes more interesting for profits of up to nearly € 400,000.

Index business tax tips:

- Change in box 2 and corporate tax

- Increasing of support rates in the Environmental Investment Allowance (MIA)

- Introduction of tax-free work from home allowance

- Increase tax-free reimbursement

- Stock options become more attractive as a remuneration

- Private use electric car

- Excessive debts of a shareholder to his own BV

- Loss relief corporate income

- Simplification of the one-stop-shop system in the VAT rules for e-commerce

- Bills to prevent tax avoidance for international companies

- UBO register

- Other tax tips

- Corona measures

Change in box 2 and corporate tax

The rate in box 2 will not be changed this year. This concerns income from a substantial shareholding, such as dividends and capital gains on equity interests above 5%. The rate remains 26.9%.

The corporate tax rate will be increased this year. Apart from that, the tax brackets are also modified. The corporate tax rate was 15% on the first €245,000 profit and 25% for profits above €245,000 this was 25% in 2021. In 2022, the rate will be 15% on the first € 395,000. The rate for profits above € 395,000 will be increased to 25.8%.

Increasing of support percentages in the Environmental Investment Allowance (MIA)

The government wants to minimize pollution and is therefore making environmentally-friendly investments more attractive for companies. The environmental investment deduction (MIA) allows companies to deduct a percentage of the investment costs from the taxable profit. As of January 1, 2022, the support percentages in the Environmental Investment Allowance will be increased. The support percentages were 13.5%, 27%, and 36%. The proposal is to increase these percentages to 27%, 36%, and 45% respectively.

Introduction of tax-free work from home allowance

Because many people have been working from home since the corona crisis (and this indirectly costs the employee money; more energy consumption, coffee consumption, etc.), the cabinet has decided to introduce a tax-free working from home allowance. As a result, employers can reimburse a maximum of € 2 per day or part of a day worked. The tax-free travel allowance of € 0.19 per km will continue to exist. Despite the rising prices of petrol and diesel, the travel allowance will not be increased but will remain at € 0.19 per kilometer. The fees cannot be paid at the same time; per day you can either opt for payment of the work from home allowance or payment of the travel allowance.

An employer may already provide a tax-free allowance for setting up a home workplace. The employer can reimburse the costs for, for example, an office chair or computer screen via other specific exemptions from the work-related costs scheme.

Increase tax-free reimbursement

Employers may reimburse certain expenses to their employees tax-free up to a maximum percentage of the total wage sum. In the context of the corona support measures, the maximum tax-free reimbursement to employees has been temporarily increased from 1.7% to 3% over the first € 400,000 of the wage sum. This temporary measure has been extended for the 2021 tax year. Do you still want to make use of this? Then you are still up to and including 31 December 2021 to reimburse the employee for certain costs tax-free. A bonus can also be paid out under this arrangement if this is customary (partly depending on the amount of the bonus). In 2022, the free space will be reduced again to 1.7% over the first € 400,000 of the wage sum and 1.18% on the excess. This arrangement comes in addition to expenses that are tax-free anyway, such as claiming business mileage at € 0.19 per km. Please contact your advisor for further information about the conditions.

Stock options become more attractive as a remuneration

Employers can offer their employees stock options as remuneration instead of paying them wages. This mainly occurs in companies that have just started (startups), because they do not yet have enough money to pay an appropriate salary. With stock option rights, the employee is given the right to buy a certain number of shares at a predetermined price in a certain period. Currently, tax is levied when the employee converts the options into shares. The disadvantage of this, is that the employee has to pay tax now, while they are not always allowed to sell the shares, in order to have the cash to pay the taxes. The government’s proposal is that employees can now choose when they pay tax. In future, the employee would be able to choose: either pay tax when the shares are tradable (and therefore money is available) or pay tax when the options are converted into shares (as it is now in 2021 ). This bill has been deferred for further consideration, and it is not clear yet whether or when it will come into force.

Private use electric car

As announced last year, the fictitious amount for the private use (‘bijtelling’) of electric cars will be further increased. In 2022, this addition will be increased to 16% on the first € 35,000 (this was 12% on the first € 40,000) and 22% on the excess. From 2023, the proposal is to shorten the first bracket to € 30,000.

Excessive debts of a shareholder to his own BV

It was previously announced that borrowing from a private limited company by a shareholder is to be limited. This plan would be implemented from 2022 onwards. However, this has been postponed to 2023. In addition, the State Secretary has asked the House of Representatives to continue the discussion in connection with a broader discussion about the tax treatment of assets that is being held in the formation of a new cabinet. It is to be expected that a new government will come up with further details.

Regarding this plan, from 2023 onward, loans or current account amounts in excess of an amount of €500,000, would be taxed at the then applicable rate in box 2 (rate 2022: 26.9%). Under certain conditions, an exception applies to home loans. In the case of large loans or current account debts, it is important to anticipate this and start with repayments, or to reserve money for the tax settlement.

Loss relief corporate income

Currently, companies can offset losses against profits from the previous year or the six consecutive years. No maximum amount applies. From 2022, up to €1,000,000 of the profit can be offset against losses. Only 50% of the profit that exceeds €1,000,000 be set off against tax losses. In addition, the time limit of 6 years will be canceled; losses can be settled indefinitely. Unfortunately, the restriction applies to all Dutch companies, regardless of whether these losses originate from abroad. For small companies, the longer term for loss set-off may actually be an advantage.

Simplification of the one-stop-shop in the VAT rules for e-commerce

New VAT rules for e-commerce apply from 1 July 2021 onwards. This concerns Dutch companies that sell to consumers in other EU countries. The rules consist of a lower threshold for distance sales and a simplified VAT declaration via a one-stop shop system so VAT does not have to be paid separately in each EU country. The rules apply when the Dutch webshop achieves an annual turnover of € 10,000 or more with sales to consumers in EU countries outside of the Netherlands (Dutch VAT may be charged below this).

The thresholds for intra-EU distance sales per individual EU country have been abolished. There is now 1 joint threshold amount of € 10,000 on an annual basis. The entrepreneur has to keep an eye on the threshold amount every year. As soon as the limit of € 10,000 is reached, the local VAT rate of the country where the private customer lives, must be applied from that moment on. In the following year, the entrepreneur should continue to invoice the local VAT of the EU country. If the entrepreneur’s turnover in the year after that was below the threshold of € 10,000, then Dutch VAT may be charged again. The entrepreneur may also choose to continue to invoice with the local VAT rate of the EU customer. The foreign VAT return can be filed separately for each EU country, or via the one-stop-shop- system. This is a new system for submitting VAT returns in one return for multiple EU countries.

The rules have also changed for the import of products from outside the EU that are delivered directly to consumers in the Netherlands, which is called dropshipping. Due to the expiry of the exemption, Dutch VAT will have to be paid on this. Also for this arrangement, a simplified procedure is in place for import VAT declarations. If you have further questions about these regulations, please contact us.

Bills to prevent tax avoidance for international companies

In addition to the aforementioned bills on the Tax Plan 2022, the following two bills have been submitted to the House of Representatives to tackle mismatches and tax avoidance in international structures:

- Bill on ‘Combating mismatches in the use of the arm’s length principle: adjustment of the rules of arm’s length transfer pricing between international groups in order to prevent tax mismatches. In short, this bill means that a reduction of taxable profit is only permitted if this is deducted by an increase in the foreign tax base;

- Bill ‘Implementation tax liability measure from the second EU anti-tax avoidance directive’: the tax liability for reverse hybrid entities. In short, this proposal means that under certain circumstances the country of residence follows the qualification of the country where the participants or shareholders are established.

UBO register

Since September 27, 2020, it is mandatory for (many) entrepreneurs to register their UBO in the UBO register. The register was created to prevent illegal acts such as money laundering and terrorist financing being carried out with financial constructions. UBO stands for Ultimate Beneficial Owner. These are persons who own more than 25% of the shares, or economic interest, or actual control of the company.

The following companies must register a UBO in the UBO register:

- Unlisted private and public limited companies(BVs and NVs)

- Foundations(stichtingen)

- Associations with full legal capacity/with limited jurisdiction but with a company (verenigingen)

- Mutual insurance companies

- Cooperatives

- Partnerships: partnerships, general partnerships, and limited partnerships

- Shipping companies

- European Public Limited Companies (SE)

- European Cooperative Societies (SCE)

- European Economic Interest Groups that, according to their statutes, have their registered office in the Netherlands (EEIG)

- Religious denominations

If the company was registered at the Chamber of Commerce before 27 September 2020, the UBO must be registered in the UBO register before 27 March 2022. If the company is registered with the Chamber of Commerce after September 27 2020, the UBO must be registered within one week of incorporation. If changes are made to the UBO data, this must also be changed in the register, no later than one week after the change has taken effect.

The UBO can be registered at the Chamber of Commerce by means of an online UBO statement. If you need help with this or have any questions about this, we will be happy to assist you.

Other tax tips

- Do you have a lot of savings and your own BV? You may consider transferring your savings to the B.V. by means of a share premium deposit before the end of the year. If the deposit is made before the end of the year, you will no longer have to pay box 3 taxation on that amount in 2022. It is important that you are aware of the conditions and consequences.

- Do you expect to pay tax for the tax year 2022? If you request a provisional assessment in good time, this will save you tax interest. The tax rate for income tax entrepreneurs is currently 4%. For corporate tax, this percentage is normally 8%, but this has been reduced to 4% due to the Corona crisis. From 1 January 2022, this percentage will (probably) be reset to 8%.

- Did you find out that you forgot to include some items in your VAT return? Then submit a supplement declaration. You can do this for this year or for the past 5 years. If it concerns VAT to be received or remitted of € 1,000 or less, this is allowed to be included in the next VAT return. You do not need to submit a separate supplementary declaration for this.

- Do you drive a company car and do you use this car privately? In that case, a correction must be made for private use in the last VAT return (to be submitted in January 2022). This may be based on actual use or on the basis of a fixed rate. Do you have questions about this? We are happy to help you.

- If you have made sufficient investments to qualify for the small-scale investment deduction, but have not yet paid all investments, we advise you to make these payments before the end of the year so that you are eligible for the small-scale investment deduction. You are eligible for the small-scale investment deduction when the total investment is higher than€ 2,400.–.

- Has your partner worked in your business this year but has not received compensation yet? Then consider paying compensation before the end of the year. This is deductible in your business. For your partner, this reimbursement is taxable in box 1. The rate depends on your partner’s total Box 1 income and is especially advantageous if your partner has a low income.

Corona measures

With the rising Covid cases and new lockdown measures, the government has revived some of the business support measures such as the NOW and TVL. The NOW (Emergency Bridging Measure for Employment) provides compensation for wage costs in the event of a loss of turnover in order to maintain as much employment as possible. The Fixed Cost Allowance, or TVL, helps SMEs to pay part of their fixed costs. Also, the deferral of tax payment deadlines has been extended until the end of this year under certain conditions. As the measures are based on the temporary lockdown measures, these change continually. Please check for the most recent updates at https://business.gov.nl/corona/financial-support-measures/corona-support-for-entrepreneurs-after-1-october-2021/