End of year tax tips 2022

We would like to inform you about the latest tax changes and saving opportunities with this end-of-year newsletter. We hope you will benefit from this newsletter. Please contact our office for more information and personal advice. We have distinguished our tips and hints between private and business. Please go ahead and read what applies to your situation!

With kind regards,

J.C. Suurmond & zn. Tax consultants

Trusted advisors since 1986

Untaxing taxes!

Tax Plan Summary

This is the first budget of the new Rutte IV government, which, as expected, incorporates many of the plans in the coalition agreement. In addition, a number of changes from the ‘Voorjaarsnota’ (Spring Memorandum) have been included in response to budgetary challenges due to, amongst others, the consequences of the war in Ukraine and the Supreme Court decision for box 3.

The box 1 Income Tax is reduced slightly. This is offset by a number of other increases in, for example, the property transfer tax and Box 3 levy for second homes. Corporate income tax for Ltd’s will also be increased, reversing earlier cuts. There has been much talk this year about the box 3 levy following the Supreme Court’s Christmas ruling with significant implications for the way it is levied. You can read more about it below, both about the corrections over previous years and what the situation looks like from now on.

A selection of some tips before the end of this year:

– If you still want to make use of the increased gift exemption of €100,000 for your child’s own home, this is possible until 31-12-2022 at the latest. Under certain conditions it is possible to spread the actual payment over 2022 and 2023.

– The new box 3 levy is based on different asset categories; you could possibly take advantage of this by adjusting the composition of your assets before 31 December. This could include, for example, converting low-yielding investments or loans (receivables) that are currently taxed at the highest rate to low-taxed savings.

– For 2023, the rate of income tax deductions for higher-income earners will again be reduced with 3%; if it is possible to bring deductible expenses forward, the deduction will yield more this year.

Index individuals tax tips:

- Changes box 1 Tax – Income from work and first-residence property

- Supreme Court ruling and corrections box 3 levy

- ‘Mass appeal’ for non-objectors box 3 tax

- Box 3 calculation – levy on foreign property

- Changes 2023 Box 3 – Benefit from savings and investments

- Limitation to shifting between box 3 categories

- Reduction in the rate of deductible items for higher incomes

- Limitation of 30% ruling for high wage earners

- Increasing taxation on second property

- Last chance for high tax-free gift ‘jubelton’

- Replacement deduction for training costs

- Other tax tips

Index business tax tips:

- Change in corporate tax

- Change in box 2 tax- income from substantial shareholdings

- Tax-free allowances employees

- Tax free scheme

- Termination of efficiency margin for usual wage

- Restriction on borrowing from own company

- Loss relief corporate income

- Bills to prevent tax avoidance for international companies

- UBO register temporarily out of public access

- Other tax tips

Individuals tax tips

Changes Box 1 Tax – Income from work and first-residence property

In 2023, the rate in the first bracket will be reduced from 37,07% to 36,93%. The threshold for the first bracket has also been raised this year, from € 69.398 to € 73.071. The rate for the second bracket remains 49,50%.

| Income Tax – AOW not reached | 2022 | Income Tax – AOW not reached | 2023 |

| First bracket up to € 69.398 | 37,07% | First bracket up to € 73.071 | 36,93% |

| Second bracket from € 69.398 | 49,50% | Second bracket from € 73.071 | 49,50% |

A three-bracket system still applies to taxpayers who have reached the state pension age. Disc 1 goes from 19,17% to 19,03%. The second bracket goes from 37,07% to 36,93% and the third bracket remains 49,50%.

| Income Tax – AOW reached | 2022 | Income Tax – AOW reached | 2023 |

| First bracket up to € 35.472 | 19,17% | First bracket up to € 37.149 | 19,03% |

| Second bracket: € 35.472 – € 69.398 | 37,07% | Second bracket: € 37.149 – € 73.071 | 36,93% |

| Third bracket from € 69.398 | 49,50% | Third bracket from € 73.071 | 49,50% |

| *other brackets apply to people born before 1 January 1946 | |||

For box 2 rates, please refer to the business section of the newsletter.

Supreme Court ruling and corrections box 3 levy

Legal proceedings have been going on for years about the fictitious way of levying tax on the box 3 capital. After all, a fictitious return was assumed that was many times higher than that received on the savings account. The rulings for previous years however all turned out negatively for taxpayers. Ultimately, however, the Supreme Court ruled last December that the fictitious calculation of box 3 for the years 2017 and 2018 can be disproportionately burdensome and therefore in violation of the human rights treaty. According to the Supreme Court, legal redress must be offered to taxpayers who have objected.

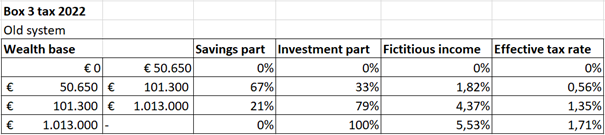

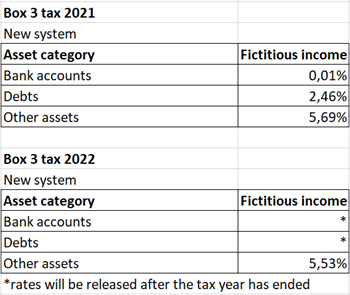

The Tax Office has worked out this correction of taxes by taking into account the actual composition of their assets and not the fictitious progressive rates. A fictitious return is still assumed; the return on savings has been sharply reduced to 0,25% or less based on actual interest rates. However, the highest percentage of around 5,5% applies to all other assets. A lower percentage of around 3% applies to debts. The tax-free allowance is calculated at a weighted average rate. In any case, generally this will provide a better connection to the actual wealth situation. Since the fictitious return on other capital is calculated based on the highest percentage, the new calculation is not necessarily more favourable in all situations. However, if this turns out to be less favourable, the existing box 3 calculation will remain in effect. From 2023, only the new system will be applicable.

Below is an overview of the old box 3 tax system in 2022.

‘Mass appeal’ proceedings for non-objectors box 3 tax

It was announced on the 4th November that a supplementary procedure, ‘massaal bezwaar plus’, will be set up for non-objectors. If it follows from this appeal procedure that non-objectors are eligible for legal redress, this restoration will take place in the same way as for objectors. Taxpayers will then no longer have to make an individual request. By doing so, the Tax Office wants to prevent large numbers of appeals being filed again. This mass appeal procedure specifically is for those who did not timely submit an appeal. If you have lodged an appeal, but still do not agree with the outcome for other reasons, we recommend you do submit a request. This may concern, for example, the allocation between partners or the calculation of the levy on foreign property. For the year 2017, this request will have to be submitted before the end of 2022. For more details about this, please contact our office. If you have any questions about this, please contact our office.

Box 3 calculation – levy on foreign property

Incidentally, there are some ambiguities regarding the calculation of the double taxation deduction on foreign real estate. In our view, the deduction was calculated in an unfavourable way, assuming the average rate instead of the high rate applied to real estate. The Tax Office has since started correcting the previous deductions itself. In addition, the choice between the old or the new system is also not unambiguous in situations involving double taxation deductions. We recommend checking these cases extra carefully and raising an appeal if necessary.

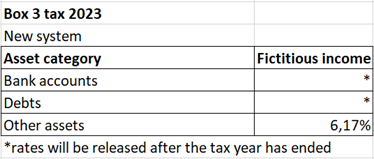

Changes 2023 Box 3 – Benefit from savings and investments

From 2023, the new box 3-system will apply. Under this system, the categories of savings, other assets and debt each have their own percentage of notional return. In 2023, the tax-free wealth will be increased to around € 57.000 (€ 114.000 for tax partners). Based on the asset mix, an average return is calculated on the total assets. The rate on the notional return in box 3 will be 31% in 2022. This rate will be gradually increased annually by 1% to 33% in 2024, thus reaching 32% in 2023.

It is planned to introduce a tax system based on actual returns and capital gains by 2026. This follows the Supreme Court’s ruling on the notional return; however, in practice, there are many snags in any system. Consequently, much is still unclear about the new box 3 tax, and it remains to be seen whether it will actually be introduced in 2026.

Limitation to shifting between box 3 categories

Under the new system of box 3 taxation, savings are taxed more favourably than other assets. To prevent taxpayers from shifting their assets between the different asset categories just around the tax reference date for box 3, a provision has been included in the Box 3 Bridging Act. If a transaction falls within a three-month period around January 1, it is ignored for the purpose of calculating the box 3 tax on 1 January. Therefore, due to this provision, temporarily converting assets does not result in lower taxation. If the conversion, for example from investments to savings, was more than three months ago at the time this conversion is reversed, it does not fall under the reference date arbitrage limitation. If the transaction is not for tax reasons then this also does not fall under the reference date arbitrage; for this, the tax authorities can request documentary evidence to establish this. The first reference date of the new system is 1-1-2023.

Shifting between asset categories around the reference date of 1 January is therefore, in principle, only successful if the shift is maintained for three months. Of course, costs of transferring securities and other assets should also be taken into account. Do you have any questions about this arrangement? If so, please contact us.

Reduction in the rate of deductible items for higher incomes

As already mentioned in 2020 and 2021, the highest rate at which virtually all deductible items are to be deducted is gradually being decreased. It can therefore be advantageous to bring forward deductible costs where possible. Taxpayers whose income falls in the highest bracket in box 1 will gradually have less tax advantage from these deductible items. In 2023, these deductible items may be deducted at a maximum of 36,93%, compared to 40% in 2022.

This concerns the following deductions:

- Alimony

- Deduction of study costs

- Deduction of expenses for specific healthcare costs

- Deduction of weekend expenses for disabled

- Gift deduction

- Mortgage interest deduction

- Entrepreneurial deduction (self-employer’s deduction, research and development deduction, cooperation deduction, starter’s deduction in the event of incapacity for work, discontinuation deduction)

- Profit exemption for small and medium sized businesses

Due to this reduction, the deductible items will yield more in 2021 than in 2022 and the following years. If your income falls in the highest tax bracket in 2021, it is therefore advisable, if possible, to pay deductible items such as gifts or healthcare costs before the end of the year.

Limitation of 30% ruling for high wage earners

The 30% rule for incoming employees will be limited to the WNT norm(also known as the Balkenende norm) from 1 January 2024. In 2022, this norm will be €216.000 on an annual basis and in 2023 €223.000. There is a transitional arrangement for incoming employees for whom the 30% rule was applied over the last pay period (December) of 2022. For existing 30%-ruling cases the capping of the 30% rule only applies from 1 January 2026, instead of 1 January 2024. So if you were planning to hire an incoming employee with a salary above the WNT norm early next year, the employee will benefit from an additional two year if the employment starts already as of 1 December 2022. Please contact us for advice on the possibilities.

Increasing taxation on second property

From 1 January 2023 the property transfer tax when buying a second property, will be raised to 10,4%. Until now this rate was 8%. Furthermore from 2023 onwards the correction that was possible based on the rental status of a second property will be limited. Whereas until 2022 the value could be reduced to 45% of the WOZ-value, from 2023 onwards this will be a maximum of 73%. If you would like to know how this will work out in your situation please contact our office.

Last chance for high tax-free gift ‘jubelton’

In 2022 it is your last opportunity to donate the so-called ‘jubelton’ of € 106.671 to your child or anyone other person tax-free. The condition is that the receiver spends this amount on an own home within 3 calendar years and that he or she is between 18 and 40 years old on the date of the gift. From 2023, this exemption will only be €37.231.

The general annual gift exemptions are yet available to be made use of this year. Please note that the money must be credited to the recipient’s account by December 31, 2022 at the latest. There is a general exemption of € 2.274. An exemption of € 5.677 applies to gifts to children. In addition, there are a number of one-off gift exemptions (for example, for a study or the purchase of a primary residence). If you have any questions regarding these exemptions, we will be happy to assist you.

Replacement deduction for study costs

From tax year 2022 onward, study costs are no longer deductible from the income tax. The tax deduction will be replaced by the STAP budget subsidy scheme (Incentive for the Labor Market Position). This budget will apply to people with a link to the Dutch labour market. From 1 March 2022, workers and job seekers can apply for a STAP budget at the UWV. This is possible per person once a year. The budget is €1.000 per person per year. If the application is approved, the amount is paid to the trainer. Only study costs paid until 2021 can still be deducted in the Income tax returns.

Other tax tips

- Do you expect to pay tax for the 2022 or 2023 tax year? Requesting a provisional assessment in good time, will save you legal interest. Interest is calculated if the assessment is imposed later than 6 months after the end of the calendar year (1 July 2023). The tax interest is at least 4%. To ensure that the assessment is imposed in time, we recommend that you apply for it before 1 April 2023. The assessment for the 2022 tax year must be paid at once. There is the possibility of paying the assessment for the tax year 2023 in instalments. Do you have questions about this? We are happy to assist you in applying for a provisional assessment.

- If you expect to receive a refund for 2017, an Income Tax return for this year must be submitted before December 31, 2022. In 2023, the 5-year term for submitting this declaration will expire.

- If possible, bundle deductible expenses such as medical expenses and donations in one specific year. For example, a deduction is achieved earlier and the threshold is only deducted once from the expenses. For donations, the threshold disappears completely if you commit the donation to a charitable institution for 5 years.

- The income-related combination discount can be applied to people with children under the age of 12. The conditions are that both partners work. The income-dependent combination discount will be increased to € 2.694 in 2023. From the 1st January 2025, the income-related combination discount will be abolished. Children born before this date will still be entitled to this tax credit for 12 years. However, there is still talk of a transitional arrangement, the outcome of which is not known at the moment.

Business tax tips

Change in corporate tax

The corporate tax rate will be increased this year. Apart from that, the tax brackets are also modified. The corporate tax rate was 15% on the first €395.000 profit and 25,8% for profits above € 395.000 this was 25% in 2021. In 2023, the rate will be 19% on the first € 200.000. The rate for profits above € 200.000 remains 25,8%.

| Corporate tax 2022 | 2022 | |||

| First bracket up to € 395.000 | 15% | |||

| Second bracket from € 395.000 | 25,8% | |||

| Corporate tax 2023 | 2023 | |||

| First bracket up to € 200.000 | 19% | |||

| Second bracket from € 200.000 | 25,8% |

Changes in box 2 tax – Income from substantial shareholdings

The box 2 rate remains unchanged at 26,9% for 2023. A two bracket tax rate will be introduced in box 2 from 2024. This concerns income from substantial shareholdings, such as dividends and capital gains on shareholdings above 5%. The rate in 2024 will be 24,5% for the first €67.000 and 31% for the amount above that. Since this applies per partner, a total of € 134.000 can be taxed at the low rate in case of tax partnership.

| Income tax box 2 | 2022 and 2023 | Income tax box 2 | 2024 |

| Flat rate | 26,9% | First bracket op to € 67,000 | 24,5%% |

| Second bracket fron € 67,000 | 31% |

Tax-free allowances employees

Because many people have been working from home since the corona crisis (and this indirectly costs the employee money; more energy consumption, coffee consumption, etc.), the cabinet has decided to introduce a tax-free working from home allowance. As a result, employers can reimburse a maximum of € 2 per day or part of a day worked. The tax-free travel allowance of € 0,19 per km will continue to exist and will be raised to € 0,21. The allowances cannot be paid at the same time; per day you can either opt for payment of the work from home allowance, or payment of the travel allowance.

An employer can provide a tax-free allowance for setting up a home workplace. The employer can reimburse the costs for, for example, an office chair or computer screen via other specific exemptions from the work-related costs scheme.

Tax free scheme

We would like to make you aware of the possibility under the Dutch Wages Tax Act to make a payment on a tax free basis for certain reimbursements which normally would be regarded as taxable income. This year this tax free scheme (‘vrije ruimte’) is maximised at 1,7% of the total company wages up to € 400.000,– and 1,18% beyond that. If you have not paid any other reimbursements or benefit in kind to employees including directors which could be regarded as taxable wage, you could still make use of this scheme by paying out a tax free bonus. An amount up to maximally € 2.400 would be seen as common. A temporary widening to 3% over the first €400.000 of the wage bill applies for 2023. This is reduced again from 2024 to 1,92% of the wage bill up to € 400.000.

Termination of efficiency margin for usual wage

Director-major shareholders (>5% shareholding in a BV) are subject to the customary wage scheme. In 2022, the salary could in principle be set 25% lower than what was customary for employees in employment with a third party, also known as the efficiency margin(doelmatigheidsmarge). From 2023, the efficiency margin will be abolished and the salary must therefore be at least equal to that of someone with the most comparable employment. This could therefore result in a salary increase and additional payroll tax to be paid by director-major shareholders before 2023.

Restriction on borrowing from own company

The possibility to borrow from one’s own BV will be restricted as of 2023, in connection with the entry into force of the Excessive Borrowing from Own Company Act(wet excessief lenen). If a shareholder borrows more than € 700.000 from his or her own BV, the excess will be taxed in box 2 (once). The first tax reference point is 31 December 2023. First home equity debts do not count towards the € 700.000 limit if they are covered by a notarial mortgage deed (a mortgage deed is not required for home equity debts existing as of 31 December 2022). In the case of high loans or overdrafts, it is important to anticipate this and start repayments in advance, or reserve money for the tax settlement. Specific rules also apply in partner situations. Is your debt to the BV higher than € 700.000 or were you planning for this? Contact our office to discuss the possibilities and consequences.

Loss relief corporate income

Currently, companies can offset losses against profits from the precious year or the six consecutive years. No maximum amount applies. From 2022, up to €1.000.000 of the profit can be offset against losses. Only 50% of the profit that exceeds €1.000.000 be set off against tax losses. In addition, the time limit of 6 years will be cancelled; losses can be settled indefinitely. Unfortunately, the restriction applies to all Dutch companies, regardless of whether these losses originate from abroad. For small companies, the longer term for loss set-off may actually be an advantage.

Bill to prevent tax avoidance for international companies

In addition to the aforementioned bills on the Tax Plan, the following two bills have been submitted to the House of Representatives to tackle mismatches and tax avoidance in international structures:

– Bill on ‘Combating mismatches in the use of the arm’s length principle’: adjustment of the rules of arm’s length transfer pricing between international groups in order to prevent tax mismatches. In short, this bill means that a reduction of taxable profit is only permitted if this is deducted by an increase in the foreign tax base;

– Bill ‘Implementation tax liability measure from the second EU anti-tax avoidance directive’: the tax liability for reverse hybrid entities. In short, this proposal means that under certain circumstances the country of residence follows the qualification of the country where the participants or shareholders are established.

UBO register temporarily out of public access

The EU Court of Justice recently ruled that that the provision in the European Anti-Money Laundering Directive, which requires Member States to ensure that any member of the general public must have access to UBO information, is insufficiently substantiated and therefore invalid. Making the information of UBOs publicly accessible constitutes a serious interference with the right to privacy, according to the Court. As a result, the obligation that the UBO register be accessible to everyone is in question. In response, the government has decided that pending further decision-making, the Chamber of Commerce will temporarily stop providing information from the UBO register.

The above does not affect the duty for legal entities to register UBOs. Since 27 September 2020, it is mandatory for (many) entrepreneurs to register a UBO in the UBO register. UBO stands for Ultimate Beneficial Owner. These are individuals who own more than 25% of the shares or hold the economic interest or have effective control of the company.

Other tax tips

- Do you expect to pay tax for the tax year 2023? If you request a provisional assessment in good time, this will save you tax interest. The tax rate for income tax entrepreneurs is currently 8%.

- Did you find out that you forgot to include some items in your VAT return? Then submit a supplement declaration. You can do this for this year or for the past 5 years. If it concerns VAT to be received or remitted of € 1.000 or less, this is allowed to be included in the next VAT return. You do not need to submit a separate supplementary declaration for this.

- Do you drive a company car and do you use this car privately? In that case, a correction must be made for private use in the last VAT return (to be submitted in January 2022). This may be based on actual use or on the basis of a fixed rate. Do you have questions about this? We are happy to help you.

- If you have made sufficient investments to qualify for the small-scale investment deduction, but have not yet paid all investments, we advise you to make these payments before the end of the year so that you are eligible for the small-scale investment deduction. You are eligible for the small-scale investment deduction when the total investment is higher than € 2.400.–.

- Has your partner worked in your business this year but has not received compensation yet? Then consider paying compensation before the end of the year. This is deductible in your business. For your partner, this reimbursement is taxable in box 1. The rate depends on your partner’s total Box 1 income and is especially advangtageous if your partner has a low income.

- From 1 January 2025, the BPM exemption for company vans will be abolished. However, the exemption will continue to apply to vans purchased before that date. So if you were planning to purchase a van for your business anyway, it will be advantageous if this takes place before 1 January 2025. However, the BPM exemption will continue to apply to emission-free vans.

- Additional measures have been announced regarding repayment of corona tax debts. We ask you to contact us for further clarification.